Source: Factset

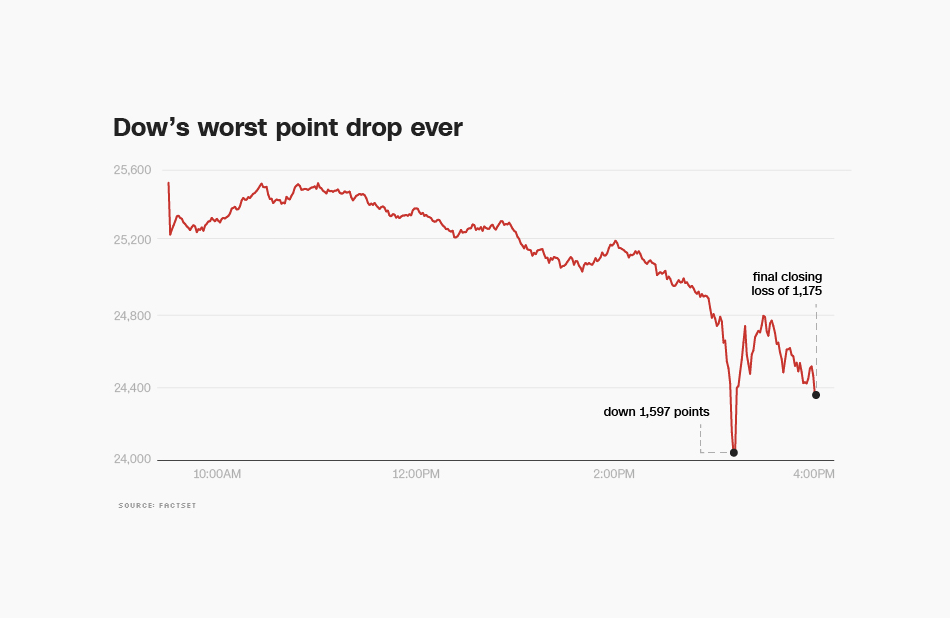

The post-recession bull market is starting to slow down as evidenced by yesterday’s worst single-day point decline in Dow history. The previous record was set on September 29th, 2008 when the Dow fell 777 points. Now, it’s more important than ever to make sure that your retirement plan is ready for anything. By taking action early, you can keep yourself on-track for a healthy retirement nest egg. There are a few quick and easy things you can do today to help make sure that your nest egg is secure from the roller coaster on Wall Street. Here are our 3 helpful steps for you to consider to crash-proof your retirement plan.

Step #1 – Don’t Panic, and Check Your Asset Allocation

Stocks have been booming for the past 9 years as the market bounced back from the Great Recession. But the days of record-breaking increases has (for now) come to a stop as evidenced by the Dow Jones Industrial Average’s single-day plunge of 1,175 points yesterday. But, don’t panic right away because depending on your unique situation and the outlook on the market, you may miss out on potential gains to come. To find out your exposure to a stock market crash, you need to know how much of your money is tied into your investments, and which investments are most in danger. So the first step to crash-proofing a retirement plan is to know how much of your nest egg is in cash, and how much is in stocks or bonds. You shouldn’t take the easy way out and just assume that your asset exposure is around where it has been in the past. Your portfolio could look very different than it did the last time you actually checked it, due to the market favoring stocks recently. Once you have hard numbers on how much money you have in each category, figure out what percentage of your overall savings fall into each category: cash, stocks, or bonds.

Step #2 – Use Recent Downturns as a Guide

Remember, the closer you are to retirement, the more you want to aim for an even balance of stocks and bonds in your portfolio in order to help minimize your exposure to risk. There’s never any way to know in advance what the next major challenge to the markets will be. So the next-best way to prepare yourself is to look at what kinds of setbacks the market has faced lately. That means it’s time to look at how the Great Recession impacted investors. We saw a 55 percent drop in stock prices from their pre-crash high to the post-crash low. Meanwhile, the bond market gained about 7.5 percent in that same timeframe. That doesn’t mean that it’s time to throw out every stock you’ve ever touched, but it does mean that if your current portfolio favors stocks heavily, it’s time to rebalance. Try looking at your current portfolio and imagine what would happen to it if we went through something like the Great Recession again.

Step #3 – Evaluate How a Setback Could Impact Your Retirement Plans

There are plenty of online calculators that can estimate for you how likely you are to retire on schedule. They’re called “Retirement Income Calculators,” and they take information like your age, income and savings, to guess your chances of retiring at the age you say you want to. But, you can also use these calculators to see how your chances change if there’s another market crash. Just take your estimate from the example of how a second Great Recession would impact your savings. Use that number for your savings instead of your actual savings, and you’ll see how much your chances of retiring on-schedule drop. That can give you a better sense of if you need to take major action to protect your savings, or if your personal risk is relatively minimal.

These 3 steps to help crash-proof your retirement plan is just a general exercise to help prepare you for the roller coaster on Wall Street. It’s important that you diversify for today’s changing market landscape by taking more than just stocks and bonds into consideration. CLICK HERE to request your complimentary, no obligation financial review and we can sit down to discuss your personal situation and help evaluate your plan for the future. One thing that always holds true is the need for a comprehensive, personal plan regardless of what goes on in the market. We can help you with your personal saving and investing strategies to help you achieve your retirement goals.